Asset-specific BESS revenue benchmarking you can trust

We help BESS owners and investors understand what revenues were realistically attainable for their batteries. Our physics-aware benchmark translates complex power-market behaviour into clear metrics that reveal and quantify underperformance.

BenchmarkPro

An asset-specific benchmark to assess BESS market performance in detail.

Configure your asset

Our model can be configured in depth to align BenchmarkPro's digital twin with your BESS.

- Configure the model using your asset's parameters for outputs, efficiencies, SoC limits, and degradation.

- Our trading-grade model accounts for capacity headroom, portfolio churn, transaction costs, trading frictions and curtailment, so the benchmark reflects how a real trader can actually operate your asset.

- Powerful but simple: one-page cockpit that auto-saves and allows for rapid configuration.

Detailed market dispatch

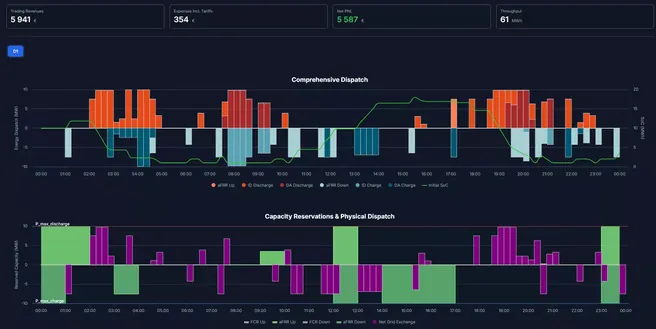

Our detailed PnL baseline built via backcast of your asset's BESS dispatch on the entire product stack.

Key metrics- Detailed dispatch by market product at 15-minute granularity across day-ahead, intraday and ancillary services (FCR, aFRR capacity and aFRR energy).

- Detailed physical charge/discharge & capacity commitment delivery.

- Realised vs benchmark analysis: dispatch & SoC delta analysis.

- Block P&L delta shift analysis by product.

- Actual vs Model P&L waterfall analysis.

Performance monitor

Follow weekly/monthly performance of your asset vs. realized PnL and identify underperformance at a glance.

Key metrics- Monthly, weekly or YTD daily aggregates of PnL by market product.

- Follow-up of throughput by day and cumulative degradation.

- Actual vs Model full-horizon PnL waterfall by product.

- Performance analysis: success rates & capacity/energy breakdowns.

Who is BenchmarkPro for?

- BESS asset owners & IPPs who want an independent view on how their optimizer or aggregator is performing.

- Investors & lenders who need a credible, physics-aware P&L baseline for due diligence.

- Optimizers & aggregators who want to prove the quality of their trading to clients.

Find out exactly what BenchmarkPro can reveal about your asset

BESS Backcast Index

- Production Backcast. Our live optimizer replays past days under real prices & market rules, unleashing the full power of our engine.

- Trader-grade behavior. Multi-horizon DA/ID/aFRR energy + FCR/aFRR capacity optimization with physics-aware constraints.

- A credible benchmark. Use our BESS Backcast Benchmark as your P&L baseline to measure alpha and benchmark realized revenues.

The Backcast Index is included in every BenchmarkPro subscription.

BenchmarkPro Pilot

Try BenchmarkPro for your battery in full for two weeks

What you get

- BenchmarkPro fully operational for your BESS asset for two weeks.

- A Performance Report of your asset vs BenchmarkPro, including underperformance events.

- Forsyt's support throughout the assignment, incl. catch-ups & technical support in business hours.

Pilot Timeline

About us

Forsyt Energy is an independent analytics company dedicated to making battery revenues transparent, comparable and trusted. We combine deep power-market expertise with physics-aware modelling to produce independent, bankable performance metrics that owners, investors and operators can rely on.

By turning complex BESS behaviour into clear evidence and benchmarks, we close the confidence gap between engineering reality and financial decisions. Our ambition is to make trustable battery economics a cornerstone of the energy transition.

Let's get in touch

Enter your email below and we'll get back to you.

Or email us directly at contact@forsytenergy.com